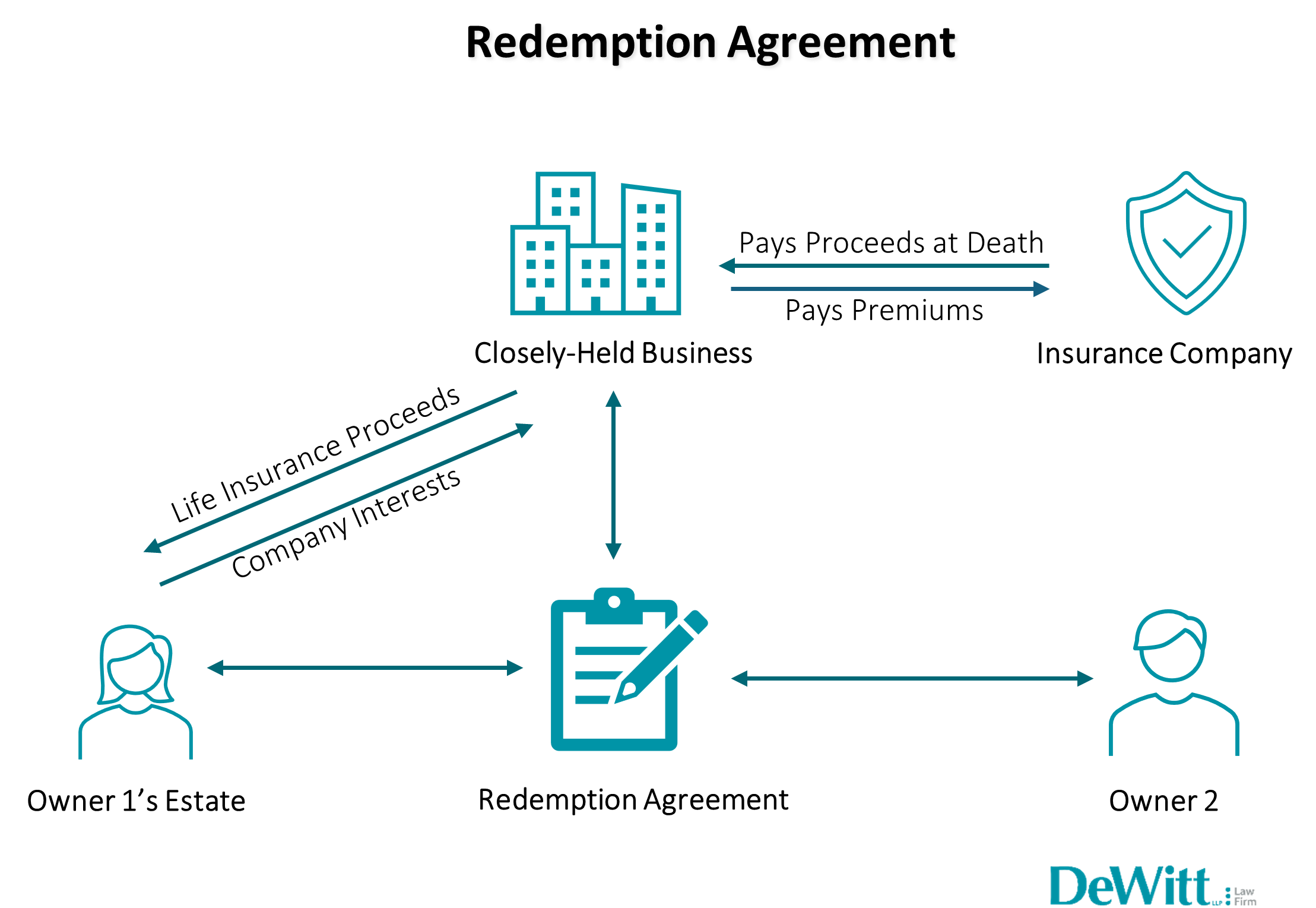

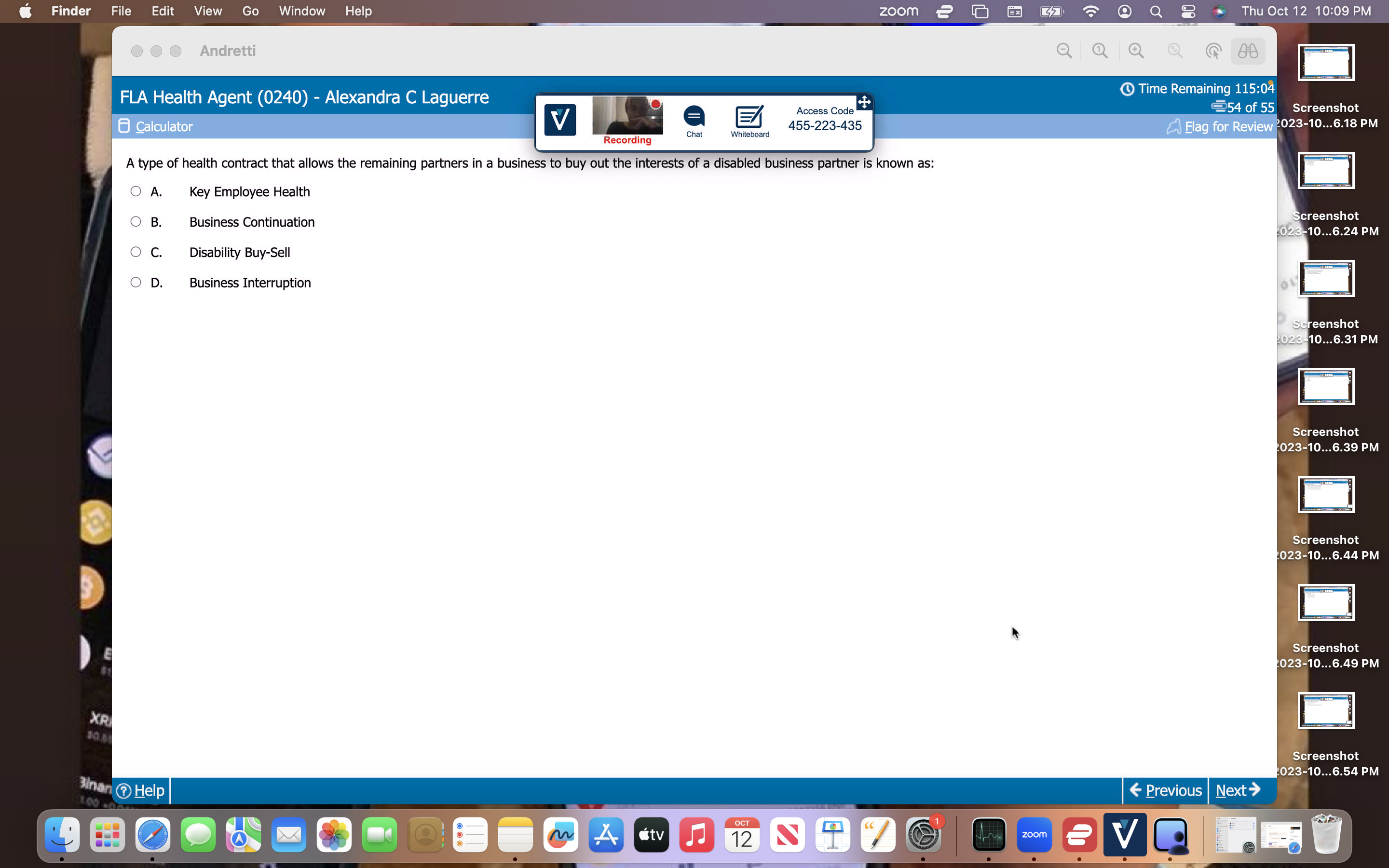

If the owner dies or becomes disabled, the policy would provide which of the. A policy owner would like to change the. With life insurance, the needs. Split dollar plan b. Benefits are taxable to the business entity b. Here’s the best way to solve it. Powered by chegg ai. View the full answer. A) the length of time a disability must last before the remaining partners can buy out the. Which of the following disability buy sell agreement is best suited for businesses with a limited number of partners. To ensure an orderly transfer of your business when you die; To set a value on the business for transfer and.

Related Posts

Recent Post

- Whio Greene County Inmates

- Sheknows Ghblog Posts

- La Fitness Premium Membershiplogin

- Jayden Liu Harvard Ma Obituary

- Batavian Obituaries

- Nwi Post Tribune Obituaries

- Dinar Guru Dinar Recaps

- Craigslist North Jersey Part Time Jobs

- Butte Mt Crime News

- Psych Rn Jobs

- New Haven Register Obituaries

- Drywallers Jobsforum Open Topic

- Max Brannon Obituaries Calhoun Georgia

- Miami Dade Cleck

- Ktnv Channel 13 News Las Vegas

Trending Keywords

- Seattle Traffic Downtownsocial Post Detail

- Zillow Recently Sold Homes

- Denton County Inmates Mugshotslibrary Detail

- Att Store Near Me Directions

- Whio Greene County Inmates

- Sheknows Ghblog Posts

- La Fitness Premium Membershiplogin

- Jayden Liu Harvard Ma Obituary

- Batavian Obituaries

- Nwi Post Tribune Obituaries

Recent Search

- Preceptaustin

- Clothes Worn On Yr

- Myshuportal

- Q43 Bus Time Schedule

- Closest Dollar Tree Store

- Post Tribune Obituaries Today

- Guinn Funeral Home Obituariesforum

- Marshel Wright Donaldson

- Labcorps Link

- What Time Is The Sunrise Tomorrow

- Bozeman Mt Obits

- Liz Dueweke

- Seattle Traffic Downtownsocial Post Detail

- Zillow Recently Sold Homes

- Denton County Inmates Mugshotslibrary Detail

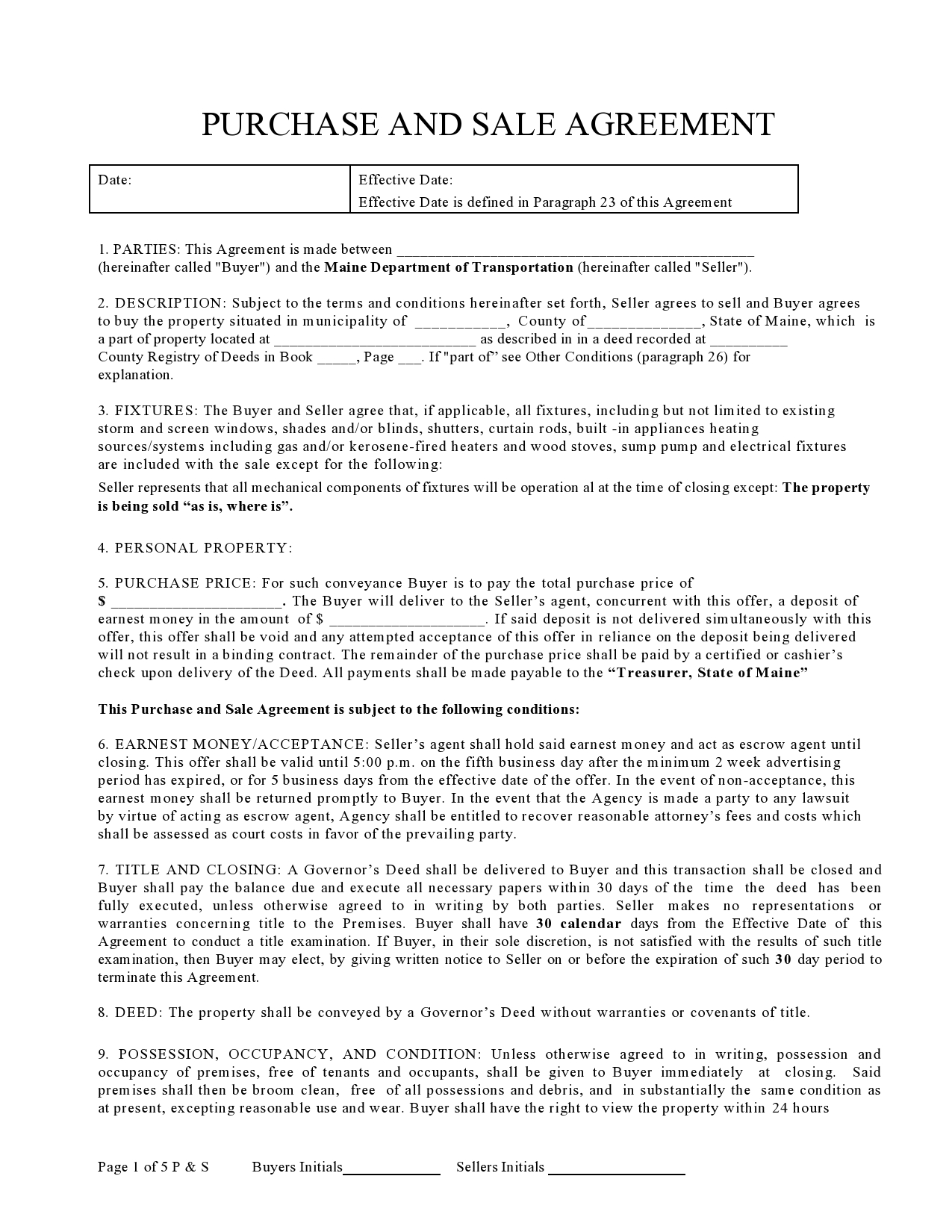

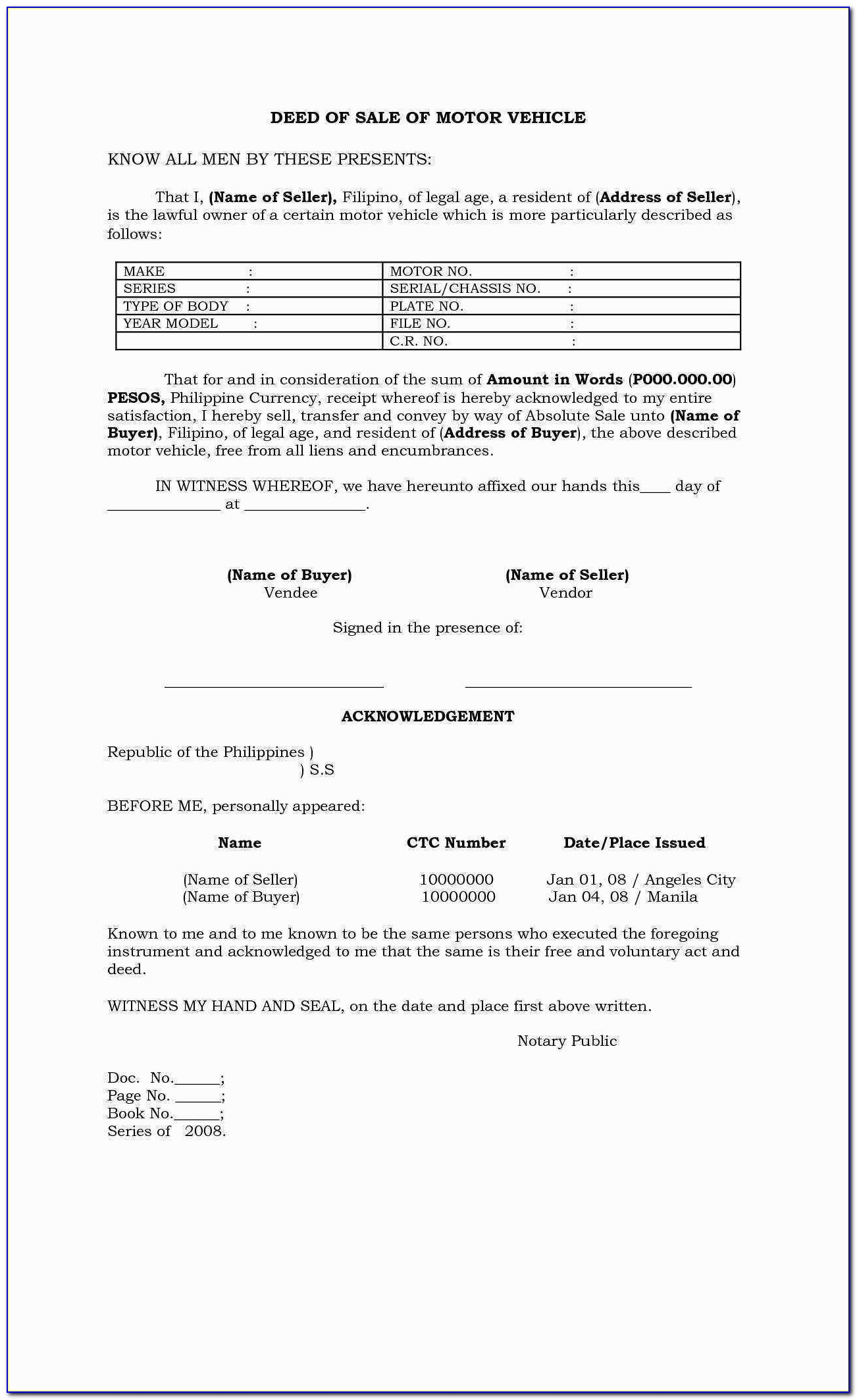

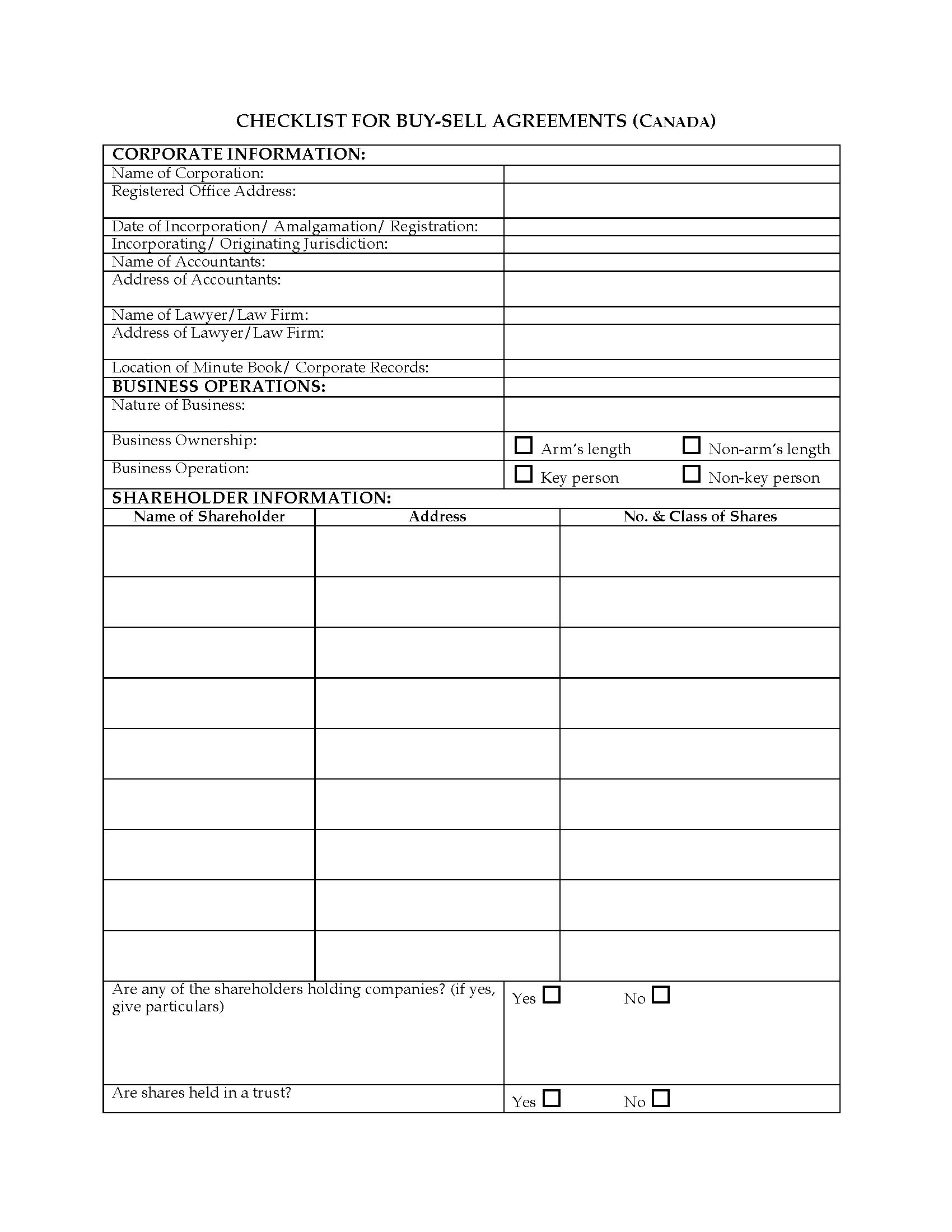

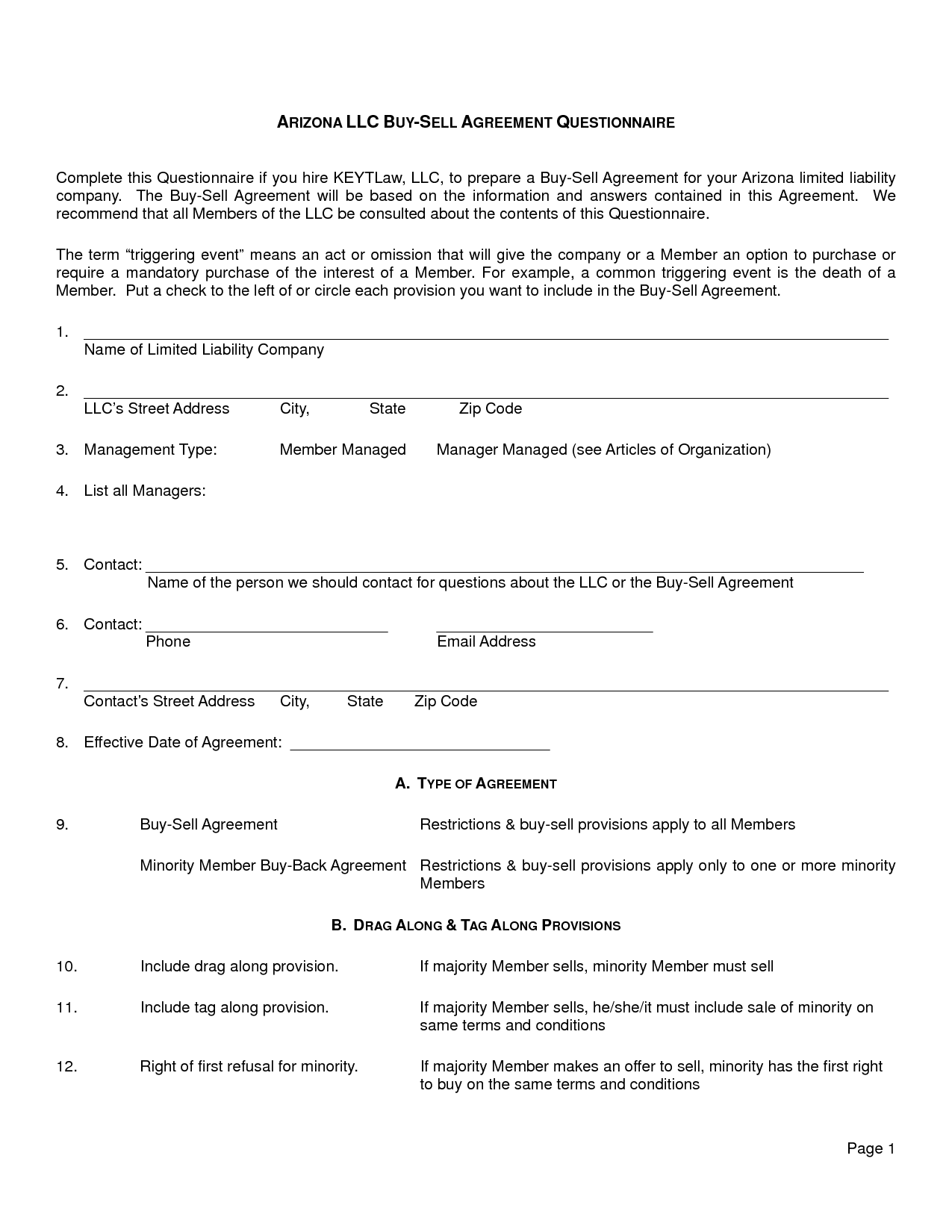

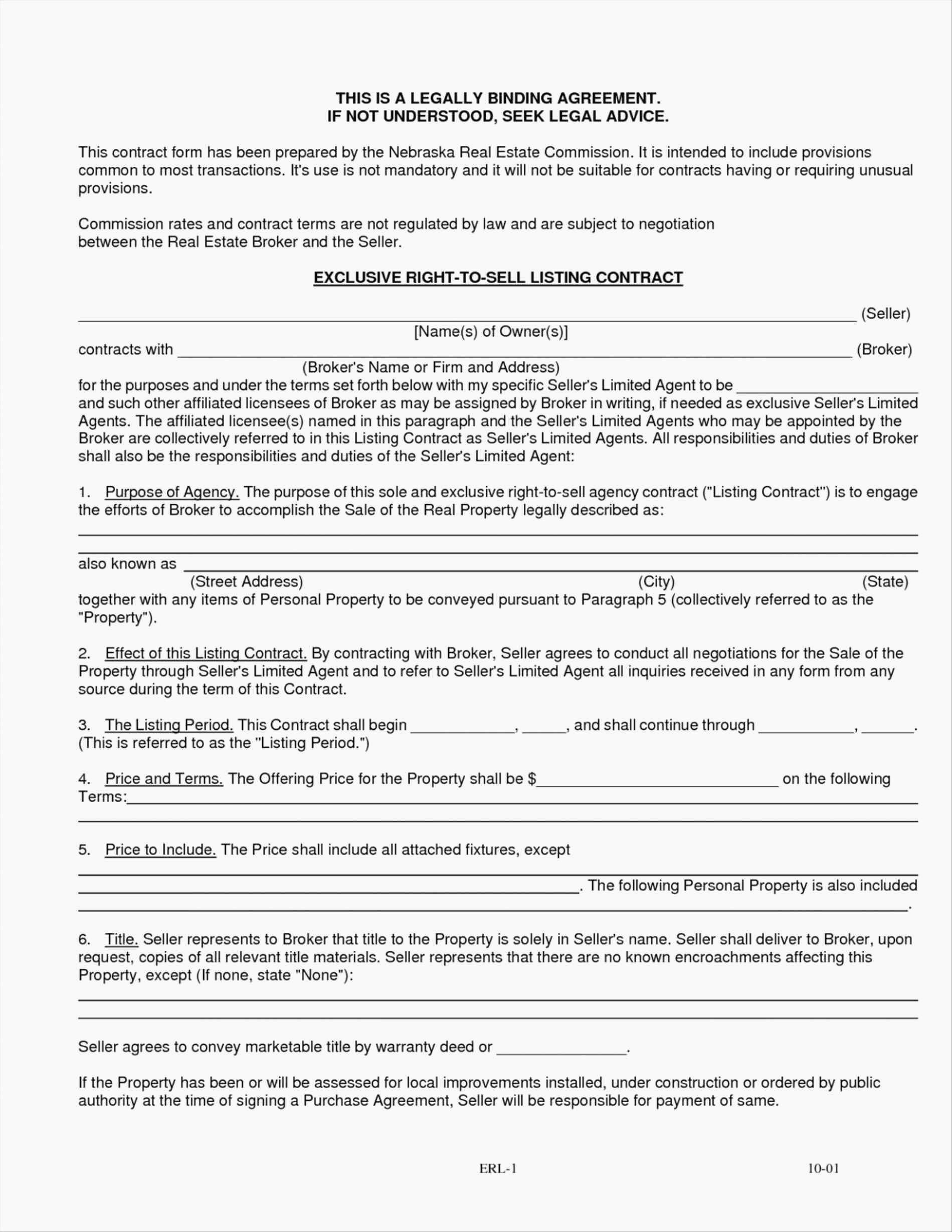

![Free Printable Buy-Sell Agreement Template [Word, PDF] Simple Free Printable Buy-Sell Agreement Template [Word, PDF] Simple](https://www.typecalendar.com/wp-content/uploads/2023/06/Sample-PDF-Buy-Sell-Agreement.jpg)

![Free Printable Buy-Sell Agreement Template [Word, PDF] Simple Free Printable Buy-Sell Agreement Template [Word, PDF] Simple](https://www.typecalendar.com/wp-content/uploads/2023/06/Buy-Sell-Agreement-Word-Document.jpg)

![Free Printable Buy-Sell Agreement Template [Word, PDF] Simple Free Printable Buy-Sell Agreement Template [Word, PDF] Simple](https://www.typecalendar.com/wp-content/uploads/2023/06/Template-of-Buy-Sell-Agreement-Free.jpg)

![Free Printable Buy-Sell Agreement Template [Word, PDF] Simple Free Printable Buy-Sell Agreement Template [Word, PDF] Simple](https://www.typecalendar.com/wp-content/uploads/2023/06/Blank-Form-of-Buy-Sell-Agreement.jpg)

![Free Printable Buy-Sell Agreement Template [Word, PDF] Simple Free Printable Buy-Sell Agreement Template [Word, PDF] Simple](https://www.typecalendar.com/wp-content/uploads/2023/06/Sample-Buy-Sell-Agreement.jpg)

![Free Printable Buy-Sell Agreement Template [Word, PDF] Simple Free Printable Buy-Sell Agreement Template [Word, PDF] Simple](https://www.typecalendar.com/wp-content/uploads/2023/06/Word-Formatted-Buy-Sell-Agreement.jpg)

![Free Printable Buy-Sell Agreement Template [Word, PDF] Simple Free Printable Buy-Sell Agreement Template [Word, PDF] Simple](https://www.typecalendar.com/wp-content/uploads/2023/06/Word-Document-of-Buy-Sell-Agreement.jpg)

![Free Printable Buy-Sell Agreement Template [Word, PDF] Simple Free Printable Buy-Sell Agreement Template [Word, PDF] Simple](https://www.typecalendar.com/wp-content/uploads/2023/06/Buy-Sell-Agreement-Template-Free.jpg)

![Free Printable Buy-Sell Agreement Template [Word, PDF] Simple Free Printable Buy-Sell Agreement Template [Word, PDF] Simple](https://www.typecalendar.com/wp-content/uploads/2023/06/Buy-Sell-Agreement-Template-Example.jpg)